Jump to

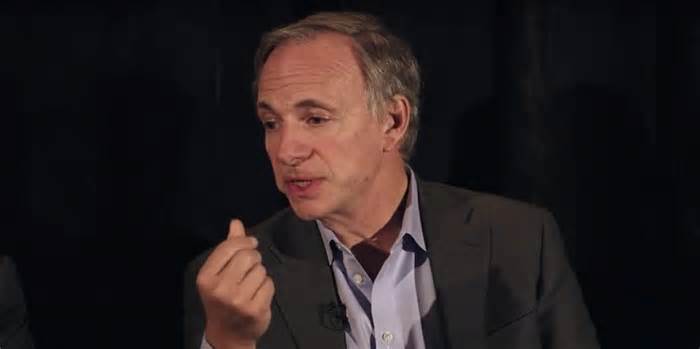

Billionaire investor Ray Dalio has doubled down on his view that cash is no longer junk, saying the dollar is more than stocks and bonds.

Dalio’s U-turn on the dollar comes as the Federal Reserve continues its ultimate competitive crusade to raise interest rates since the 1980s to inflation.

“Before, cash was zero. Money is quite exciting now. This is exciting compared to bonuses. It’s exciting compared to stocks,” the Bridgewater founder said Thursday in an interview with CNBC.

“You have the classic movement that as rates rise, the source of currencies is linked. You lose the parts of the economy, the parts of the market that are the parts of the bubble that needed the currencies to flow. So you see this reflected over the long term “– duration stocks,” but in personal equity and venture capital, he added.

Dalio, who coined the term “cash is a trash can,” in April 2020 had dismissed the dollar as virtually negligible because he expected near-zero rates and an inflated cash source to erode the cost of dollars over time. But with the Fed sharply raising interest rates to involve value pressures, the yield on the dollar has risen.

The U. S. dollar index, which measures the dollar against a basket of six currencies, hit a 20-year high last year thanks to the Fed’s immediate rate hikes. Higher interest rates help the dollar as they tend to attract more foreign exchange investment.

Meanwhile, stocks and bonds have taken a hit over the past year due to competitive rate hikes, with the tech-heavy Nasdaq losing about 34% last year.

“What’s also going down is that we now have the accumulation of a lot of debt and money,” Dalio added. That means dealing with issues like the U. S. debt ceiling. The price of the dollar warned.